Why you should earn your ChFC

The Chartered Financial Consultant

(ChFC

) is particularly attractive due to the recent changes in the CFP

Board's Standards of Professional Conduct since these two designations share the same core curriculum. (The ChFC

requires two additional electives but does not require candidates to pass the 10-hour, comprehensive board exam the CFP certification requires.)

The ChFC

designation provides financial planners and other industry professionals with the tools to perform comprehensive financial planning for their clients. The program focuses on the entire financial planning process as an organized way to amass information and analyze a client's total financial picture, to ascertain and implement precise financial goals, and to devise, apply, and monitor a comprehensive plan to achieve those goals.

ChFC

designees are well-qualified to help clients:

- Achieve financial goals by analyzing their overall financial picture and by identifying their life and health insurance needs as well as personal property and liability risks.

- Review their current income tax situation and develop strategies to reduce and defer income taxes.

- Increase their retirement investments by preparing tax-advantaged retirement plans.

- Identify investment opportunities and design a portfolio that conforms to their personal objectives and risk tolerance.

- Conserve existing assets and build financial security for retirement through estate enhancement.

The ChFC designation is awarded by The American College.

ChFC Program Requirements

Requirements to earn the Chartered Financial Consultant (ChFC ) designation, the following are required:

- Three years of full-time business experience prior to being awarded the ChFC designation

- Commitment to The American College's Code of Ethics

- 30 hours of Continuing Education (CE) every two years

ChFC Exam Information

ChFC

exams are administered electronically at nationwide testing centers throughout the year by The American College via the Pearson VUE testing center network.

The exam consists of 100 objective questions based on the curriculum and is two hours in length. Typically, there are three types of questions included in the ChFC exam-straight-answer, multiple-option, and all-except questions.

Your results will be provided immediately upon exam completion.

ChFC Exam Information

ChFC

exams are administered electronically at nationwide testing centers throughout the year by The American College via the Pearson VUE testing center network.

The exam consists of 100 objective questions based on the curriculum and is two hours in length. Typically, there are three types of questions included in the ChFC exam-straight-answer, multiple-option, and all-except questions.

Your results will be provided immediately upon exam completion.

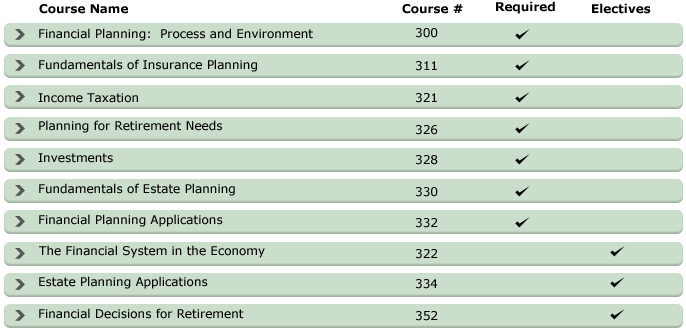

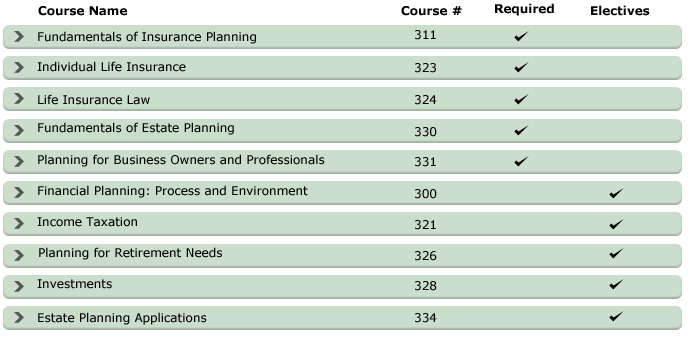

ChFC Curriculum

You will need to pass nine examinations, one for each of the following seven required courses and two elective courses, to earn the ChFC designation: