Why you should earn your CLU®

The Chartered Life Underwriter (CLU®) designation has been regarded as a highly respected mark of educational achievement and professional excellence. CLU® designees are well-qualified to help clients in the areas of:

- Life insurance

- Business planning

- Estate planning

In fact, those holding a CLU® designation can average a 51%* greater income than their counterparts because they have the specialized skills to help clients:

- Achieve financial goals by analyzing their overall financial picture and by identifying their life and health insurance needs as well as personal property and liability risks.

- Attain financial security through life insurance and annuity products.

- Manage successful businesses with strategic organizational and preventive planning.

- Enhance estate value, conserve existing assets, and provide for financial security during retirement.

The CLU® designation is awarded by The American College.

CLU® Program Requirements

To earn the Chartered Life Underwriter (CLU®) designation, the following are required:

- Complete CLU® coursework within five years from the date of initial enrolment

- Pass the exams for all required and elective courses. You must achieve a minimum score of 70% to pass.

- Meet the following experience requirements: three years of business experience immediately preceding the date of use of the designation are required. An undergraduate or graduate degree from an accredited educational institution qualifies as one year of business experience.

- Take the Professional Ethics Pledge.

- When you achieve your CLU® designation, you must earn your recertification every two years.

CLU® Exam Information

CLU® exams are administered electronically at national testing centres throughout the year by The American College via the Pearson VUE testing centre network. Contact PearsonVue Education at 866-392-6822 for more information or to schedule your exam.

The exam consists of 100 objective questions based on the curriculum and is two hours in length. Typically, there are three types of questions included in the exam-straight-answer, multiple-option, and all-except questions.

Your results will be provided immediately upon exam completion

Continuing Education Requirements

Each designee who falls in one of the following categories must complete 30 hours of continuing education every two years. If you do not fall into one of these categories, you are exempt from CE requirements:

- Licensed insurance agent / broker / consultant

- Licensed security representative / registered investment advisor

- Financial consultant, attorney, accountant, employee benefits specialist, and any other individual who provides insurance, employee benefits, financial planning, or estate planning advice and counsel to the public.

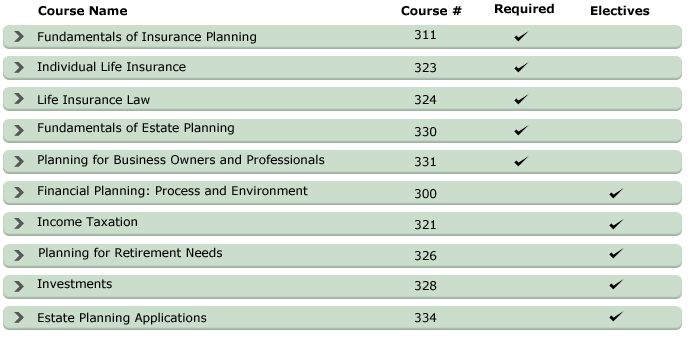

CLU® Curriculum

You will need to pass eight examinations-one for each of the five required courses and three elective courses-to earn the CLU® designation:

"ChFC®, CLU® and CASL® are registered marks owned by The American College. KAPLAN/KESDEE is not affiliated or associated in any way with The American College. The American College does not endorse, promote, review, or warrant the accuracy of any courses, exam preparation materials, or other products or services offered by KAPLAN/KESDEE and does not verify or endorse any claims made by KAPLAN/KESDEE regarding such products or services, including any claimed pass rates."